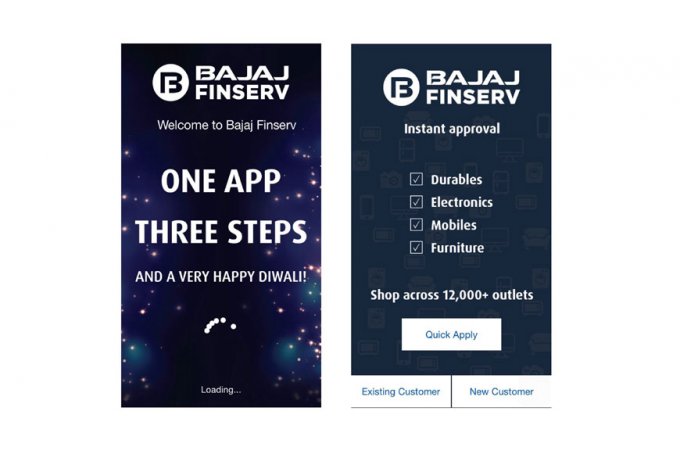

Welcome to our step-by-step guide on crafting an informative blog post about checking your EMI in the Bajaj Finance app! Have you ever found yourself struggling with understanding the intricacies of this finance application? Well, fret no more because we are here to demystify it all for you. In this blog, we will walk you through each and every detail to ensure that by the end of it, you’ll be able to navigate the app effortlessly and check your EMI like a pro. So strap in for an exciting journey as we unravel the wonders of the Bajaj Finance app together!

Introduction: What is the Bajaj Finance App?

Assuming that the reader has little to no prior knowledge on the subject, the following content would serve as an introduction to checking EMI in the Bajaj Finance App.

The Bajaj Finance App is a tool that allows users to calculate their monthly installment or Equated Monthly Installment (EMI) for a loan. The app takes into account the loan amount, interest rate, and tenure to come up with the monthly installment amount.

To use the Bajaj Finance App, simply download it from the Google Play Store or the Apple App Store. Once you have installed the app, open it and enter your loan amount, interest rate, and tenure. The app will then calculate your monthly installment and display it on screen.

The Bajaj Finance App is a useful tool for anyone who is looking to take out a loan. It can help you budget for your loan and make sure that you can afford the monthly installments.

Benefits of Using the Bajaj Finance App

If you’re looking for a quick and easy way to check your EMI, the Bajaj Finance App is a great option. Here are some of the benefits of using the Bajaj Finance App:

-You can check your EMI in just a few clicks.

-The app is available for both Android and iOS devices.

-The interface is user-friendly and easy to navigate.

-You can also use the app to make payments and keep track of your payment history.

Step-by-Step Guide to Check EMI in the Bajaj Finance App

Assuming that you have the Bajaj Finance App installed on your smartphone, follow these steps to check your EMI:

1. Open the app and sign in using your registered mobile number.

2. On the homepage, tap on the ‘Accounts’ section.

3. Here, select the ‘EMI’ option from the drop-down menu.

4. You will now be able to see all your current and past EMIs under this section.

5. Select the desired EMI to view more details about it such as payment date, amount, etc.

Features and Limitations of the Bajaj Finance App

When it comes to features, the Bajaj Finance App offers a number of great features that make it a valuable tool for managing your finances. For starters, you can use the app to track your spending and keep tabs on your budget. You can also use the app to manage your bills and payments, as well as set up customized notifications to help you stay on top of your finances. The Bajaj Finance App is a great tool for anyone looking to better manage their finances and stay on top of their budget.

There are a few limitations to the Bajaj Finance App that are worth mentioning. First, the app is only available for Android devices, so if you don’t have an Android device, you won’t be able to use the app. Additionally, while the app does offer a lot of great features, it doesn’t provide support for all financial institutions. So if you don’t bank with one of the supported institutions, you won’t be able to use the app to manage your accounts. Despite these limitations, the Bajaj Finance App is still a valuable tool for anyone looking to better manage their finances.

How to Use the Bajaj Finance App for Different Purposes?

Assuming that the reader has already downloaded the Bajaj Finance App on their smartphone, here is a step-by-step guide on how to use the app for different purposes:

– To check your EMI balance, simply open the app and login with your registered mobile number. On the homepage, you will see your account summary which will include your current EMI balance.

– To make a payment towards your EMI, click on the ‘Make a Payment’ option on the homepage. You will be taken to a page where you can select your preferred payment method ( debit/credit card, net banking, UPI). Enter the necessary details and complete the transaction.

– To view your loan statement or download it for future reference, click on the ‘Loan Statement’ option on the homepage. You can either view it online or download it as a PDF file.

– In case you have any queries or want to get in touch with customer care, click on the ‘Contact Us’ option on the homepage. This will provide you with various options to reach out to us such as call, email or live chat.

Tips on How to Create an Engaging and Informative Blog on Checking EMIs

If you’re like most people, chances are you have a blog or are thinking about starting one. And if you’re planning to start a blog on checking EMIs, there are a few things you should keep in mind to make sure your blog is both engaging and informative.

Here are some tips on how to create an engaging and informative blog on checking EMIs:

1. Start with a catchy headline.

Your headline should be attention-grabbing and make readers want to learn more about what they can expect from your blog.

2. Write in a clear, concise, and easy-to-read style.

When it comes to information-packed blog posts like this one, clarity is key. Make sure your readers can easily follow along by writing in a clear and concise style. And don’t forget to break up your text with plenty of headings and subheadings!

3. Use personal experiences and examples.

One of the best ways to engage readers and help them relate to your content is by sharing personal experiences or examples. Did you recently check your EMIs using the Bajaj Finance App? Tell us about it! Your readers will appreciate the relatable content.

4. Offer helpful tips and advice.

Readers come to blogs for helpful information and advice, so make sure to deliver on that promise! In this case, offer tips on how to check EMIs using the Bajaj Finance App or

in the Bajaj Finance App

The Bajaj Finance App is a great tool to use when you want to check your EMI. You can access the app by logging in with your ID and password. After you have logged in, you will see a list of options on the left-hand side of the screen. Click on the “EMI” option. You will then see a list of all your current EMIs. Select the one that you want to view and click on the “View” button.

You will then be able to see all the details related to your EMI, including the amount, interest rate, tenure, etc. You can also make changes to your EMI by clicking on the “Edit” button. This is a great way to keep track of your finances and make sure that you are always on top of your payments.

Also Check :- Top 9 Best Personal Finance Apps in India 2023.